Explore our NEW Knowledge Base and Help Desk to find everything you need to attract, engage and convert talent with your Vennture website.

Discover More

A quote from Amazon’s founder provides the perfect introduction to this blog, providing clarity on the ever-expanding mentality of the digital giant. It is a quote that should never be ignored, as it shapes the way customers interact with businesses, which in turn echoes their shifting expectation towards brands and how much they are likely to spend with them. If companies don’t move fast enough to keep up with customer’s expectations, then those businesses shouldn't expect to be operating for much longer.

The current brick and mortar shopping experience holds nowhere near the same weight it did just five years ago, with the frictionless full-time digital shopping experience being the current currency of choice. This is plain to see in the United States, where some of the biggest retailers in the country have closed 5000 stores in 2017, with the digital shopping evolution creating another 1000 planned closures over 2018.

It’s a similar story in the UK. The iconic department store, BHS, shut down in August 2016 and nearly two years on, one third of its 160 stores still lie empty. Demand for the high street has clearly dropped, but for those department stores that still exist and have moved their operations online, new business issues are arising.

Evolving digital shopping habits are impacting the way in which we consume products in the third part of the buying cycle, ‘evaluation of alternatives’. This part of the purchasing journey is where the shopper weighs up which product is most suitable for them before purchasing the product, which is the fourth stage. When shopping online, we don’t expect to taste, touch or smell the product before buying, leading to shoppers purchasing several items of the same product in multiple colours, sizes or spec, with the intention of returning the products that don’t match up to our expectations.

For example, we don’t try clothes on in fitting rooms anymore. Instead shoppers have evolved to be comfortable in waiting for the postman to deliver our latest purchase and try it on in our own home. This behaviour has led to 63% of online shoppers returning items they don’t want during their statutory cooling off process, with retailers having to recover costs somewhere, which are fuelled by the one-click purchases, driven by ecommerce websites permanently testing UX to keep the customer engaged.

The question is, how can traditional stores that are still yet to embrace ecommerce, evolve their business, internal operations and marketing processes to appeal to a new shopping culture?

Stores that haven’t yet moved fully into ecommerce need to seriously consider digital as their key platform, as high street sales fell 2.3% in December 2017, which is the fifth consecutive year of decline. In stark comparison, ecommerce sales were up 21.4% in December 2017 when comparing to the same period in 2016, with research from Forrester predicting that online retail sales could account for €378 billion across Europe by 2021.

Amazon, in contrast to some of the historically established department stores on our high street, were born into digital and have evolved faster than most companies at scale. What were a Seattle start-up selling books online, has become an all-encompassing sprawling digital network that increased revenue by $42 billion in the last 12 months. More impressively, Amazon have played a significant part in evolving decades old shopping habits, shifting our expectations of service, speed and returns, with social media working in unison to change the ways in which we now interact and rely upon real-world brick and mortar stores.

32.08 million people in the UK are employed, which is an important point, because the hours that we are working often dictate when our free time is to travel to the high street and shop. The Seattle start-up realise this and are fully aware that the general public want to shop on their own terms.

Amazon have created a shopper that is totally un-reliant on brick and mortar stores, enabling them to shop on their own terms, when and where they want and still get the product delivered to them before the end of the day, through ingenuity such as Amazon Key and Amazon Locker, removing the need for you to ever knock on the door of that neighbour you dislike who has your parcel waiting for you.

Amazon aren’t only dealing with speciality products though. Supermarkets need to investigate ways to evolve and get further into the homes of their customers. Amazon Dash can be set-up in the cupboard where your products are stored and connected to the in-house Wi-Fi. So, when something is close to running out, just press the button and Amazon will have it delivered within the same day. The evolution here is that Amazon are moving into shopper’s homes, whilst supermarkets aren’t thinking further than their ecommerce experience. Which case is more revolutionary?

The ecommerce giant has evolved a platform that is blurring the boundaries of what we consider non-digital, creating a lifestyle of what I have coined, ‘full-time online’.

Full-time online shopper expectations are constantly evolving, creating a culture that has no intention of communicating with high street stores in a traditional sense that the likes of M&S and BHS were used to.

The full-time online shopper mentality is constantly evolving, but the thing is, full-time online is fluid and has been around for a few years, through other sectors adopting digital and the expectations that come with it.

It can be seen from some of the everyday things that we now do. Activities that we take for granted but are intrinsically woven into our daily life. For example, 5.7 million people in the UK watch TV on demand through Netflix, Spotify is rapidly on the rise with 159 million active users, newspaper sales are famously declining however the New York Times and The Washington Post are seeing exciting numbers of digital subscription growth and the mobile only bank, Monzo, a 2015 start up already have around 400,000 active customers. The list can go on and on.

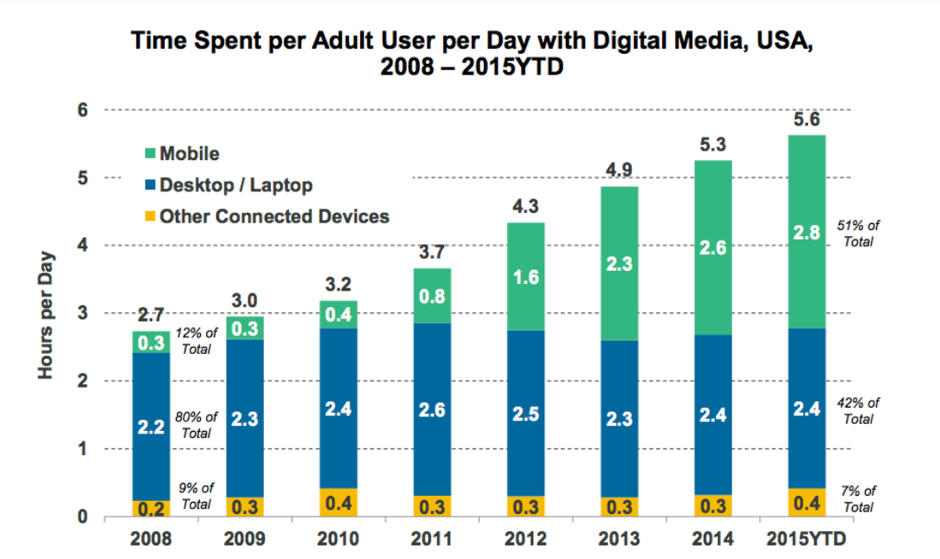

Full-time online means we are online increasingly more often during the waking hours. We still access desktop relatively consistently, but mobile is eating up the hours where we would have traditionally been offline, such as sitting and watching TV in the evening, as the data from Mary Meeker highlights below.

The public are embracing full-time online without even realising it. Validation from peers provide the trust factors for adopters further down the curve, which are coming from forums and reviews which are baked into many consumer based technology platforms.

Monzo has a forum acting as a key validity factor for the early majority, who are beginning to trust and adopt technology for safely storing their money in the online bank, instead of more traditional methods that include paperwork and ‘real-world’ interaction. But for the adoption to happen, consumers need to feel confident that their access to money remains safe and stable, which is the primary reason Monzo has a forum. Engaged users create validation through answering the questions of newer customers, creating endless information from an endless amount of questions people will ask about online-only banking.

Netflix shows all have reviews, providing mass validity for whether a programme is worth watching. Would we ever go back to those pre-historic times of having a TV critic provide their subjective view on a programme and take it as gospel?

Amazon, the company who have had a huge impact in creating this behaviour, is renowned for the wealth of user generated information on each product it offers, with 38% of shoppers using Amazon as the primary place to find out more information about a product in the early stages of the buying decision.

Netflix, Spotify and Monzo can all be accessed through mobile devices. They work on-demand, are available 24 hours a day and require no human interaction. It is the exponential evolution of the mobile experience that is paramount to this shift in human behaviour, which is removing the off-line experiences of high street shopping as we knew it.

Forrester reported that we are yet to see a peak for consumer shopping on mobile devices. In fact, this growth is going to continue all the way up to 2021, meaning that the full-time online shift is only going to continue to keep on impacting brick and mortar stores, at levels I don’t believe we are anywhere near seeing at this moment in time.

This is because brick and mortar shopping can provide a highly impersonal experience, with customers often walking around stores in search of what they are looking for, sometimes with no idea whether they will find it or not. The brick and mortar store has no idea what the customer has bought from them in the past, whether they had a good/bad prior experience or any idea of how far they have had to travel to visit their store. It’s an analogue experience that is now being measured against ever evolving digital expectations.

Full-time online isn’t age or generation dependent. We would be foolish to think that millennials are the only shoppers that are embracing digital. 25% of Generation X and 24% Baby Boomers use Netflix as their TV provider of choice, with 66% responding that they use the channel as it enables them to watch at a time that is convenient to them.

M&S is a store that is notorious for being associated with Baby Boomer and Generation X shoppers, but this isn’t stopping these generations from expecting more from the high street retailer, which is leading to the closure of 30 stores around the country. Instead M&S are placing an emphasis on food stores, which they see as their point of difference. If the retailer doesn’t further evolve that experience it will be interesting to see if that difference is worth anything when Amazon Go popularises itself in the UK.

In a nutshell, the speed of the web, paired with trust garnered from social validity has created a full-time online mind-set designed to free up time in a world where attention is pulled into infinite spaces, allowing shoppers to buy what they need to, so they can go back to doing what they want to do.

The majority of the Amazon buying experience is online, but they are moving into the brick and mortar shopping through Amazon Go, though its scale is small with one store in Seattle that is open Monday-Friday 7am-9pm. But this isn’t your typical store and it will give the rest of the high street an insight into adopting full-time online, off screen.

Amazon are looking to make their brick and mortar stores focus customer centric, through technology that can understand what the customer has taken from the shelf, and let the customer walk out of cashier-less stores, with no transaction happening in the traditional sense.

A similar technology is used in Apple stores, you can pick something up such as a charging cable, scan it using the Store’s App, pay with Apple Pay, receive your e-receipt and walk out without speaking to anyone.

This isn’t the retail experience as we have ever known it. 92% of purchases are still made offline and Amazon are creating a data driven offline experience that will only fuel what it recommends to you online, further increasing consumer reliance on the all-encompassing platform.

Technology and the way that customers engage with brands online is moving through a period of constant evolution and it’s encouraging to see parts of the high street embracing digital change. Debenhams have made moves to enhance the online experience for customers by building their website as a Progressive Web App, which has speeded the entire buying journey process up for online customers by an impressive 28 seconds.

Ross Clemmow, Managing Director of Retail, Digital, Food & Events at Debenhams said, ”We know customers get frustrated by a slow site, even more so on mobile, with as many as 70% admitting they would leave a site if it loaded slowly”.

Full-time online demands speed on any device that connects to the internet. Buffering and slow download speeds create experiences that are a similar irritation to queuing at check-outs in the ‘real world’ shopping experience. Optimising platform speed is why the likes of digitally born businesses such as Netflix, Amazon and ASOS are continuing to grow revenue at such high rates.

In fact, Amazon are well known within the digital industry for embracing speed online. Their CRO team are renowned for creating a near flawless online journey designed to ease the check-out process online, with one famous study showing that a page slow-down of just one second would cost the business $1.6 billion.

ASOS’ initial point of difference to physical retailers (other than the obviously being only available online) is that they created the structure to handle high levels of deliveries and returns, which has been one of the creators of its success.

Nick Robertson, the co-founder of ASOS was quoted as saying the returns policy "...means you have customers coming back really regularly, and people are going online every week to see what's new in. ASOS made returns very easy and this took other fashion players a long time to develop, the varied options ensure loyal customers”.

ASOS created this structure through ASOS Premier delivery membership, priced at £9.95 annually, with 68% of shoppers willing to pay up to 15% more for the same product/service if assured they will have a better experience. ASOS build that service into a subscription meaning that they have the resources in place to handle the volume, whilst also encouraging brand loyalty.

The scale of digital change is dependent on the expectations your customers place on your business, but more importantly it’s about your ability to understand the future of shopping habits and cater to their evolving behaviours.

Argos have a high street presence but haven’t been averse to add subtle changes to their offline experience by embracing technology. The retailer replaced catalogues for tablets, which presents a business trying to stay relevant, appeal to a new audience (from paper to digital) and also create service efficiencies in store. This change may not appear a big transformation, but ‘big’ is subjective.

Embracing digital also means that you give your customers a way to pay that is convenient for them. Don’t create minimum transaction costs so they can use their credit/debit card, it will put them off buying from you. If the cost is a problem for your business then look at alternate methods. For example, Square have low transaction fees and no monthly retainers. Whatsapp have also improved their app to let it start processing payments. If you’re business has a technical problem, then there is always a solution to that issue.

Could high street stores embrace augmented reality to enable customers to try clothes on in the comfort of their own home, without physically having the items in their possession?

Facebook bought the VR company, Oculus Rift. Facebook make money from advertising and data, but Oculus Rift created a product that could be part of the next jump in shopping behaviour, something that Facebook would inevitably want to be a part of.

This would help minimise returns for brick and mortar stores, as the shopper has a clear picture of what the product will look like on them or in the home before purchasing it. This reduces buyer friction and hesitation, leading to stores potentially opening up their products to a whole new market of shoppers.

The point of difference between one brands offering and the next is becoming increasingly blurred as more shoppers move to full-time online.

Full-time online are a community of digital only users, who see the physical boundaries and personality of each store less, but experience the speed and efficiencies of their online presence more. It’s up to the retailers to ensure that there is no feeling of compromise between their offline and online brand offering, because social validation will quickly send those stores under that don’t measure up to constantly evolving expectations.

The high street needs to better understand its customer base, through the customers needs and that their expectations of the experience that is provided for them, are constantly evolving. Full-time online is an increasing group of shoppers who want to purchase on their own terms, on-demand.

Amazon have evolved shopping experiences and always strive for more, as you can see from this final quote, but don’t let their successes be the failure of the high street.

If you have read the above and feel that you could do more to help market your business and improve your customer experience through digital, then you aren’t alone, as 55% of enterprise decision makers feel they have a timeframe of just one year to make significant inroads on their digital transformation before suffering financially.

To help businesses answer a lot of the questions posed above, Venn have created a measurable model that enables marketing departments to understand their customers and then better sell to them.

Our four-stage model known as GAIJ dissects your internal marketing practices and digital acumen. We then pair this information with customer feedback before matching all this up with several data points to create an all-encompassing sprint based strategy, enabling us to build a marketing product designed to re-engage your business with your customers.

You may need our help if you cannot answer any the following questions -

You can find out more information about GAIJ and case studies from some of the businesses that have already used this service on our digital transformation and strategy page or call us on 01625 464370 to start your digital journey.