Rightmove recently reported annual profit figures of £104 million. Indeed sold for an estimated $1 billion in 2012 and Auto Trader generated £237.7 million in 2014.

These companies are the Google equivalent of their respective industries, the go-to website for relevant products in the relevant niches. But make no mistake about it, these companies also need Google to generate huge amounts of traffic for them.

They also need the cars/jobs/houses from agencies and businesses that they are taking SERP real estate from, which is potentially empowering for the SMEs that are using their services.

Terms such as ‘houses for sale’, ‘property for sale’ and ‘estate agents’ are some of the highest performing search terms in the real estate industry according to Google Keyword Planner, with 368,000 searches per month (pm), 165,000pm and 90,500pm respectively, in the UK.

Below I have listed the top three domains in terms of ranking for each term. Does anything stand out?

Search term – ‘Houses for sale’

P1. Rightmove.co.uk

P2. Rightmove.co.uk

P3. Zoopla.co.uk

Search term – ‘Property for sale’

P1. Rightmove.co.uk

P2. Rightmove.co.uk

P3. Zoopla.co.uk

Search term – ‘Estate agents’

P1. Rightmove.co.uk

P2. Jackson-stops.co.uk

P3. Gascoignehalman.co.uk

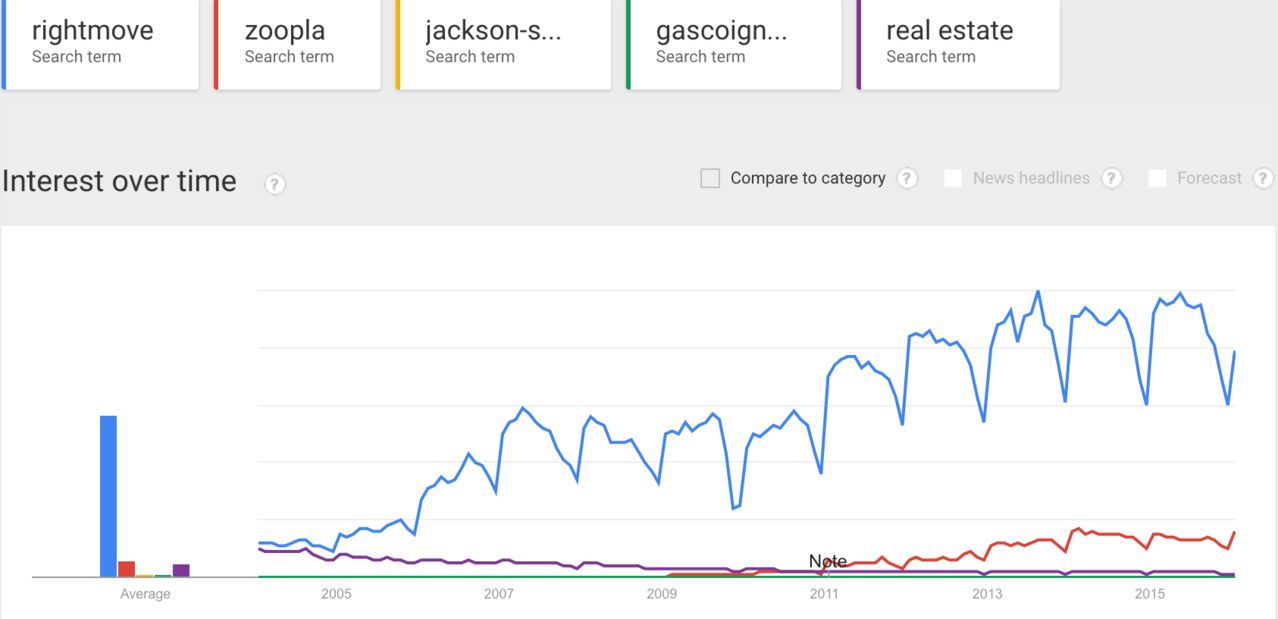

Rightmove are dominating and if we take the brand terms of these websites and look in the keyword planner for estimated monthly searches, we can see further evidence of this –

Jackson-Stops – 12,100pm

Gascoigne Halman – 12,100pm

Zoopla – 3,350,000pm

And…

Rightmove – 11,100,000pm

That’s a brand that has become significantly bigger than its industry. Its position in Google for competitive search terms and brand searches alone would suggest it is, and this is only a portion of the traffic they receive from the search giant. This number doesn’t include brand variances and keyword/brand hybrids search terms that are sending organic traffic to the real estate website.

Let’s take a look in Google Trends to get a visual of just how dominant Rightmove has become in the real estate industry:

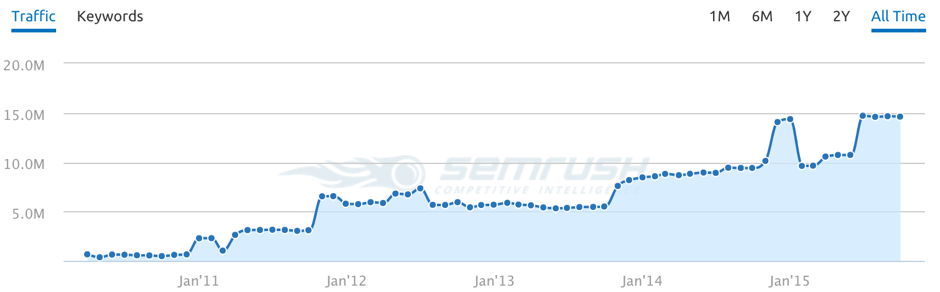

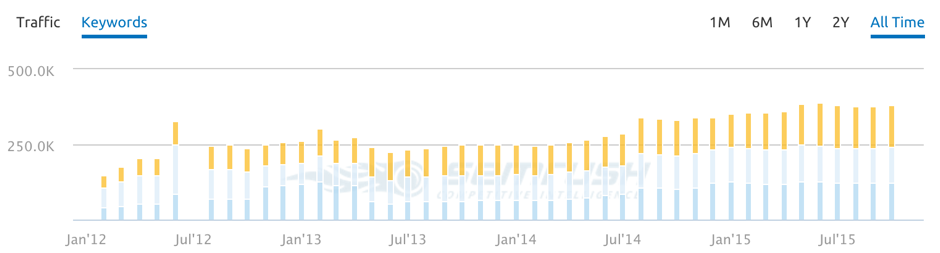

If that's not enough evidence for you then how about estimated traffic from SEMrush?

Keyword visibility?

“I’ll just Google that” and “you could eBay it” are a couple of examples where the brands have become the verbs. Only the biggest companies have made that step into the public vocabulary, but what can SMEs do to halt this growth and increase their own direct and organic traffic? How can they make their brands memorable?

We know that big brands dominate search terms within Google, Rand Fishkin explained this brilliantly here. The apparent Catch 22 in all of this is that the dominant brands can’t exist without customers placing content on them, and the customers can’t piggyback off of the dominance of these brands without sacrificing a chunk of their marketing budget and search engine visibility. SMEs are essentially feeding machines far bigger than themselves, sacrificing SERP real estate and essential brand exposure.

I won’t go into too much detail for the following industries, other than to let you know the results for each search term, as well as estimated searches for each brand term. They are essentially following a very similar pattern to that of the real estate industry, with one brand far outweighing its competition.

Search term – ‘Cars for sale’ (135,000pm)

P1. Autotrader.co.uk- (autotrader – 6,120,000pm)

P2. Parkers.co.uk – (parkers – 165, 000pm)

P3. Gumtree.com (gumtree – 9,140,000pm)

Search term - 'Car valuation' (60,500pm)

P1. Autotrader.co.uk

P2. Parkers.co.uk

P3. Whatcar.com (what car? – 135,000pm)

AutoTrader are quite obviously dominating the car buying industry but can only function from the page listing and sale of users’ cars.

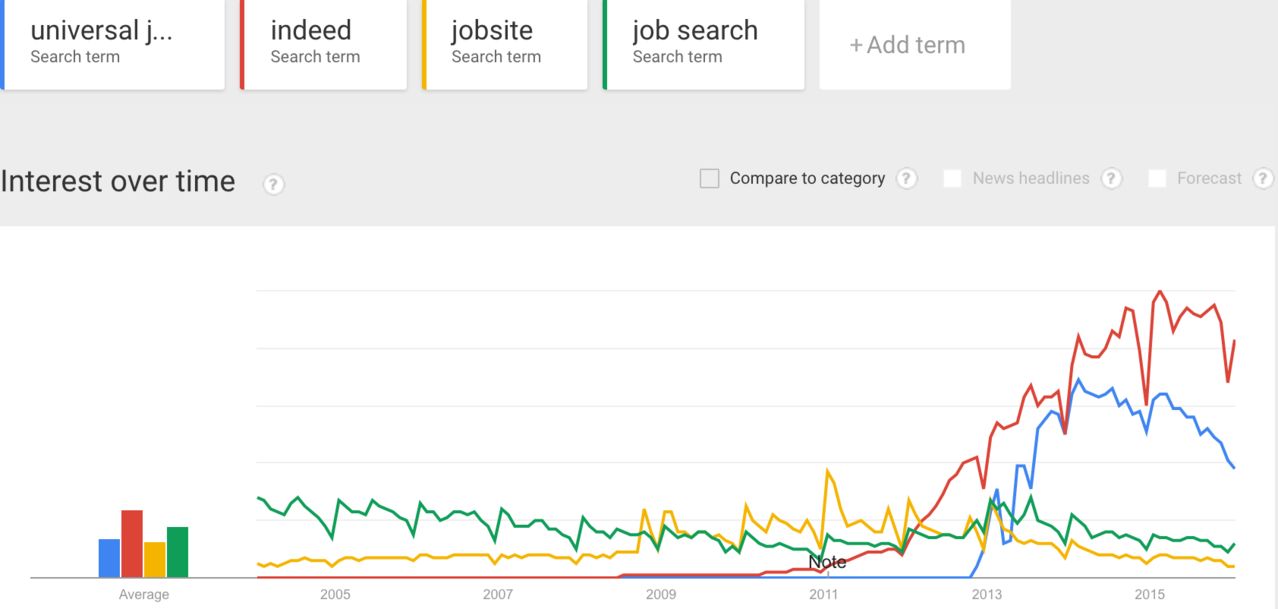

It’s the similar story for jobs and careers:

Search term – ‘Jobs’ (301,000pm)

P1. Jobsite.co.uk (jobsite – 165,000pm)

P2. Indeed.co.uk (indeed – 2,240,000pm)

P3. Jobs.ac.uk (jobs.ac.uk – 60,500pm)

Search term – ‘Job search’ (201,000pm)

P1. Jobsearch.direct.gov.uk (universal jobmatch – 1,830,000pm)

P2. Fish4.co.uk (fish4jobs – 49,500pm)

P3. Indeed.co.uk

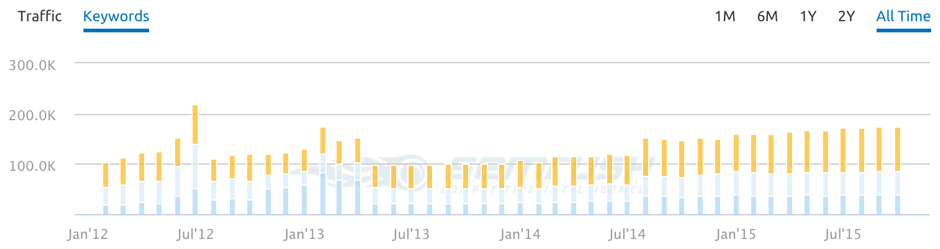

This sector is a little more unique in that users will search for a high number of niche, low volume, job specific terms. Using the above as a guide you can see that, while some of these websites are far bigger than one of the most common search terms in the industry, only Indeed truly dominates the landscape (even though they don't rank in P1 for some very competitive terms), which I wrote about here. Take a look at their keyword visibility to see just how much of the first page they really do own:

A good question for SMEs to ask themselves is, how did the industry dominant brands come to rule their respective roosts and how can we reclaim our organic brand visibility?

SMEs need to think about why they are putting their marketing budget into the monolithic brands. Obviously the giant referrers are doing something right, and that is getting relevant eyes on relevant listings, but with SMEs paying to have their content listed on these sites it is giving the huge brands, huge marketing spend, which is then prevalent in their dominance of the SERPs.

SMEs don’t have the marketing budget that is at the disposal of huge multi-nationals. They can’t afford posters on bus stops, the ability to catch millions of eyes on the London Underground via digital boards, full page spreads in The Times, paid campaigns that go into the millions…but they do have the power to retain the custom they receive from the likes of Indeed, Rightmove and Auto Trader. Infact, studies have shown that it can cost seven times more to acquire new custom than it does to retain it.

Let me give you an example:

Jane is scouring the internet for a car. She has subconsciously been taking in the marketing from all the industry leaders and decides that she is going to have a look on Auto Trader. After typing her search into Google and getting to autotrader.co.uk she sees a car that she’s fallen in love with.

Having clicked through to the listing and been referred to the car dealers website, Jane finally views the vehicle and buys it there and then.

Five years pass buy, Jane has got married, had children and has decided to look for a new car. Now the question is, does she go back to the car dealer who she bought the vehicle from, or does she go back to Auto Trader and go through the same process again?

It depends on two factors. Firstly, did the car dealer provide exceptional service that stayed with Jane, and secondly, but equally as important, have the car dealers maximised all of their marketing opportunities within the local area to keep Jane’s attention over the years?

This is how SMEs can compete with the huge referral sites and claw back some of the localised SERP real estate. Using the referral opportunities to increase their database, retain the clients through good customer service, then market to them appropriately, ready for when the time comes for them to buy a new car/home or get a new job. This will essentially reduce cost by not needing to advertise on the referrer sites, as they have retained the client, meaning they haven’t gone back to Auto Trader, only for the customer to then land on one of the SMEs competitor sites and lose their custom.

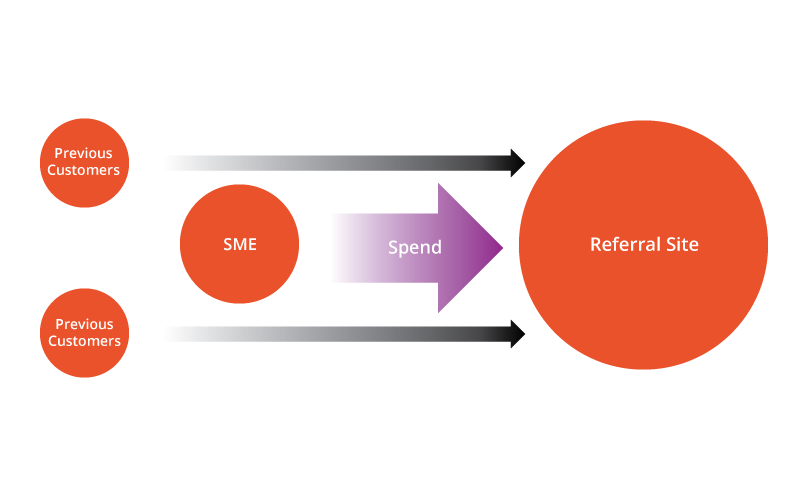

Here are two models that display what I mean:

Bad marketing and customer experience

In the above example, the customer has used the job agency in the past (alternatively it could also be their first job) and arrived on the job listing through Indeed. The SME isn't interested in having an organic/marketing presence and instead opts to outlay costs to Indeed, meaning they aren't interested in long term retention of the custom they gained previously and the cycle goes around and around.

But what can SMEs do to have a chance of lowering the dominance of the referral giants?

Good marketing and customer experience

This example shows what happens when SMEs retain clients which they have received from large referral sites. Spend is reduced, which hampers the referral sites bottom line. This is a very slow process (we are talking years and probably an online revolution, of sorts), because the SME has to keep getting the referrals through to build up a suitable database whilst gradually reducing spend. But by retaining custom, SMEs are indirectly taking SERP real estate away from the big boys. If SMEs aren’t listing property/cars/jobs on the referrer sites, then they don’t have the content to fill the landing pages, which means that they will eventually be less likely to outrank SMEs for so many search terms.

*

Are SMEs making the most of the referral traffic that is coming through to their sites from these giants? Probably not at the moment, given the growth of some of these brands. But what can the SMEs do to ensure they are making the most of the referral traffic that they are paying for?

Re-marketing should be a priority. AJ Kohn gave a great example of doing something similar with his content from StumbleUpon. Maximising the potential brand exposure from these large referrer sites is key to your local campaign, and re-marketing to those that visit your website could be the difference between them changing their mind after their initial visit and contacting you, or not (Note - Rightmove seem to have taken a leaf out of Mark Zuckerberg's book recently and stopped people leaving the site).

A well designed website/sales funnel will always help you convert. Are you creating well thought out landing pages, do your listings pages cover all areas of the entity that you are trying to sell and are you creating a clear and simple user journey? These are the kind of things that should always be considered to give you the time to long click and prove you are serving your users suitably.

Email marketing must be a priority, and you can always look at getting the email address of your customer during their initial contact with you from the referrer. Your customers are coming to you from referral sites because they are interested in what you sell. That probably means that they will also be interested in what you sell in the future, so always keeping them in the loop through your email marketing efforts means that firstly, your brand will always stay somewhere in their subconscious, and secondly, you never know when they might see a house/job/car from one of your emails that they want to know more about.

Google My Business/3-Packs are always going to help, especially when a customer has come through to your site from a referrer. If they have had a pleasant/successful dealing with you from a past referral, when they conduct future searches in Google, such as 'cars for sale', they may see your brand ranking in the 3 Pack and may come back to you based on their previous positive experience, rather than clicking through to the referrer site, which will inevitably be sat directly under the 3-Pack.

Remember just how much the referrer sites rely on Google for sending keyword traffic through to them. 3-Packs are an easy win for SMEs because if you have your house in order for localised search and ensure that you are encouraging users to rate your business via Google/Yelp etc. it further provides more positive reinforcement for your existing customer base.

Is your social media presence as good as your real world customer service? I mentioned earlier to ask for email addresses from customers that have been referred through to you, at the same time whilst you are establishing the relationship, why not ask for social handles as well? Remember to interact with your client base, advise them where needed and build relationships with them. If you already have built a relationship with a client that has come to you from one of the referrers, either through email (which can be personal), social or real world interaction, then you are increasing your chances of them not ever needing to go back to a referral giant.

If SMEs start with localised marketing, quality service that more often than not leads to word of mouth referrals, and ensuring they retain customers from their digital referrals, then they will start clawing back what they have lost from Google, and Google is where this problem started and could end.

Google don’t help the case of small businesses because Adspend on terms such as ‘Indeed’ can be high, meaning that the cost to entry isn’t even feasible to take paid traffic share from them, unless the SME can be sure it will convert a high proportion of the traffic that is essentially looking for Indeed.co.uk and not their website. You could argue that if the SME was to put its money into Google rather than one of the referral giants then what's the difference? Well, you'd be correct, and that's why I would love to see SMEs getting every single £/$ out of every single referral they get, for the entire lifespan of a customer, rather than ploughing money into paid search with no long term strategy.

For any of this to happen, a revolution in the way businesses spend money online is required. Huge brands such as Rightmove have grown user branded searches to such a degree that it has eaten away at keyword searches and the space available in the SERPs for SMEs.

Huge brands are sending the right branding signals to Google, leaving many SMEs with little option but pay to be featured on these sites. Granted, the referral giants put SMEs directly in front of their target audience, but didn’t this used to happen through organic keyword search before Google and large referral sites reshaped user search behaviour?

A lot of this post talked about branding, so why not read another post by Andrew Akesson on how brand experiences can affect customers memories.

Flickr Creative Commons Image: JD Hancock